There’s no way around it—saving for a family vacation can be tricky. But when you hear excited conversations between your children about last summer’s beach trip, or that memorable road trip stop, it can make putting money aside a bit easier.

You’d be surprised at how quickly small amounts add up. Start saving money on a few small things now, and you’ll be planning the perfect family vacation on a budget in no time, especially if you get the kids involved to help motivate you to put money aside for your next adventure.

“Getting involved in saving for a family trip is a good way for both younger and older kids to learn a valuable lesson about opportunity cost: what you give up to get something even better. It’s a lesson that will prepare them for tradeoffs to cover major expenses in the future, such as college tuition or a down payment for a car or a home,” says Beth Kobliner, author of Make Your Kid a Money Genius and member of the Council on Financial Capability for Young Americans under President Obama.

“It can be hard for kids to understand [this concept] when it comes to your big family expenses, but a vacation is something they can grasp because they will be experiencing it,” adds Danny Kofke, personal finance expert and author of A Bright Financial Future: Teaching Kids about Money Pre-K Through College for Lifelong Success.

But to have the chance to experience it, you have to save for it—so get your wolf ears ready because we have some advice to get everyone excited about how to save for a family vacation (so it doesn’t all fall on the parents).

1. Never Underestimate the Power of Planning

You’d be surprised how the bill creeps up when you toss in a few extra items each time you grocery shop. Go in with a list and stick to it. That said, we understand that can be a battle against the cries of “Mom, I want this cereal!” or, “Last week you said I could get a candy bar!”

Instead of fighting back, have your kids help with your meal planning. Ask each of them to choose one dinner for the week as well as what snack they want in their lunch boxes. That way, when you go to the grocery store, they’re getting food they want.

A trip to the grocery store is also a great opportunity to help your children understand how much things cost, as well as the value of saving. As you shop with your children, set budgets and savings goals, so they feel like they are contributing to the vacation fund. For example, if you say, “I budgeted $100 for our groceries today, but our total, because we watched our spending, came to $92. We can put that $8 in our vacation jar.”

Which gets us to our next tip. Have a vacation jar. If your child can see you put the $8 in, and can contribute themselves, they will have a better understanding of what it means to save for a big purchase. Saving and teaching—what a parental win!

2. Save Money By Eating In

We know, stopping by the drive-thru after soccer practice is sometimes the easiest choice. But if you dedicate one weekend afternoon to meal prep, you’ll set yourself up for success (and savings) for the other 6 days of the week.

Get your kids involved, too, and have them stir and measure ingredients. Plus, if they’re helping to make something they actually like to eat, they’re more likely to resist the pull of chicken nuggets or pizza. Then, when your kids come home sweaty, tired, and ravenous, dinner will be ready in a matter of minutes.

Our recommendation? Buy a pack of non-stick pans (if you don’t have them already) and work your way through this list of sheet pan dinners, or this list of healthy make-ahead freezer meals. Your future self, and your wallet, will thank you.

Some of our other prep-before favorites are hidden veggie mac & cheese and these taco bowls. Your children won’t even miss restaurant food!

Missed your weekend meal prep day? Slow cooker meals are your weekday best friend. All you need to do is pour, mix, and heat. And when you come home 10 hours later, dinner will be ready. It’s like adult magic.

But, if your kids are begging to go out, try breakfast or lunch instead of dinner. Breakfast typically costs under $10 per person, versus dinner which can run you $15 or more.

3. Find Free Activities Locally

Keeping kids busy and entertained can feel like a full-time job, especially on the weekends. But instead of going to an arcade or toy store, find free or lower-cost options. Head to the local library for story time or a free class, get out in the great outdoors for a scavenger hunt [internal link to Scavenger Hunt article] or a trip to a park they’ve never been to, or scan local moms groups and sites (like Mommy Poppins) or other no-cost options.

Stumped on free activities your kids will love? Even just swapping for a lower-cost option will help pad your wallet a bit more.

For example, taking the family to the movies adds up quickly, especially when you see the prices for popcorn and soda. Head to a matinee instead of an early evening show, where tickets are likely to be discounted. Or, rent a movie and turn your living room into a movie theatre by turning off the lights and piling pillows and blankets on the floor. The popcorn and sodas are much cheaper at home, and there’s really nothing cozier than a homemade movie tent. Challenge your children to come up with some new popcorn and candy combinations with what you have in the house, or make a themed dinner or snack.

Bonus: Incentivize Your Kids

Getting your kids to understand the need to cut back now for future fun isn’t easy. But making them a part of the process will help.

“If they want to save their own money to help out, offer to match whatever they pile up, dollar for dollar—or more if you can afford it,” says Kobliner. “To help them make money, you can pay them for extra work around the house (special things that they wouldn’t otherwise do as part of their normal household chore contributions). Tell them that if they reach a certain savings goal, they can pick an activity the family will do on one day of the trip (within some reasonable financial limits).”

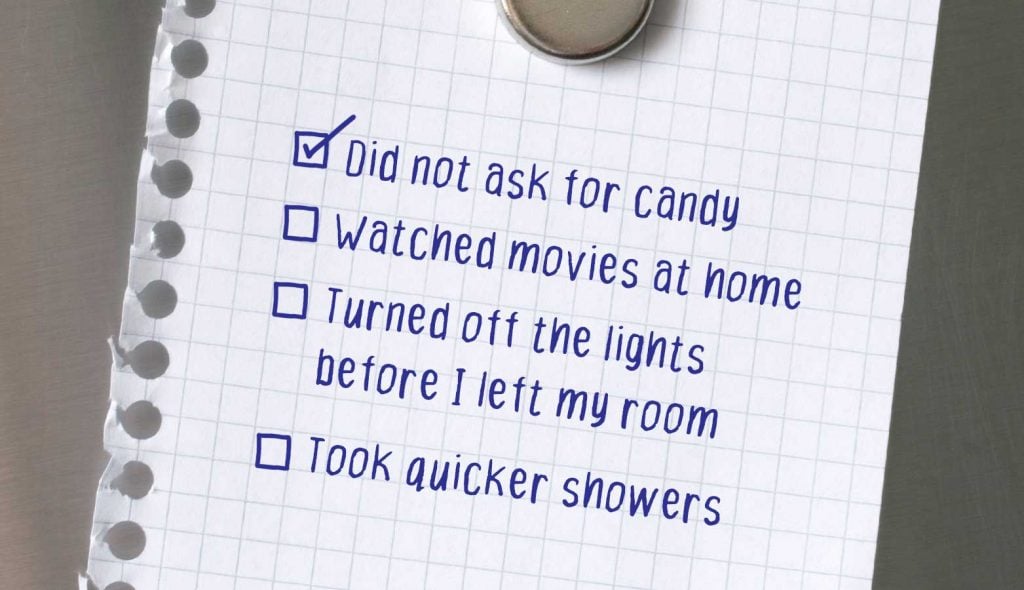

Or, plan a craft day where you collectively create an inspiration board of everything they want to do on a future family trip (this makes for a great low-cost activity, too). Next to their inspiration board, make a checklist with them of how they are going to help the family attain their savings goal, so they make their vision board a reality. Maybe it’s not asking for the expensive candy on the grocery store trip, or selling their own toys to put some money in the savings jar. This will help them understand the process of making little sacrifices for a bigger reward. Not going out for cheeseburgers every week means a day in the water park later.

Every time they complete an activity, have them check off a box. You can even reward them at different checkpoint milestones. For example, once they’ve checked off half their list, gift a small toy they can play with on the way to the trip.

4. Pay Upfront

Moms and Dads, this pro tip is just for you. There’s a great way to save money that you might not have thought of: paying upfront. We know that sometimes it’s tough to not pay over time, but paying at the time of purchase can really add up.

For example, subscriptions are typically cheaper when you pay for the entire year upfront. An annual Amazon Prime subscription is $119. Or you could pay $12.99/month for a monthly Prime subscription, which equals $155.88 over the course of a year.

Same goes with most car insurance plans. Paying in installments of six months or one year will have you spending less for the same coverage. It’s worth seeing if your homeowner’s or renter’s insurance policies are similar. So, think of anything that you regularly buy or subscribe to and look into annual or semi-annual payments. Even saving $20 a year is ice cream for all on your next family getaway!

While saving is never fun, for adults or kids, these tactics will help you put money aside every so often so you can afford the family vacation you’ve been looking forward to. Vacation is much more enjoyable when you know it’s paid for—and getting the family involved will make it that much easier.

Paying upfront is probably the best way to keep vacation costs low in the long run, as it ensures that you get the best price locked and you don’t have to worry about as many surprise expenses down the road.

Totally agree Carola!